In the fast-paced world of global finance, speed and efficiency are not just advantages—they are necessities. Traders and financial institutions constantly compete to execute trades in fractions of a second, where even a microsecond delay can mean the difference between profit and loss. This is where High Frequency Trading Servers play a critical role. Designed for speed, reliability, and performance, these specialized servers are transforming financial markets and enabling traders to gain a significant competitive edge.

What Are High-Frequency Trading Servers?

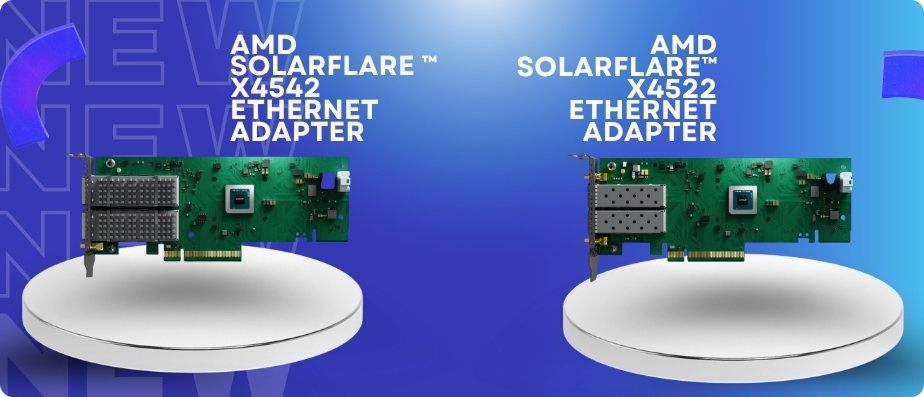

High-frequency trading Servers are purpose-built computing systems designed specifically for executing trades at lightning-fast speeds. Unlike conventional servers used for general business operations, these servers are optimized for ultra-low latency, high throughput, and real-time market data processing.

They combine powerful processors, optimized hardware architecture, and advanced networking capabilities to ensure trades are executed in microseconds. By leveraging such high-performance systems, traders can act on fleeting opportunities in the financial markets and maximize returns

The Importance of Speed in Financial Markets

Financial markets operate in real time, where millions of transactions occur simultaneously across the globe. In this environment, every millisecond counts. The faster a trade is executed, the greater the chances of profiting from price discrepancies and short-term market movements.

For example, when stock prices change rapidly due to breaking news, only those with the fastest systems can take advantage of the price gaps. High-frequency trading Servers enable traders to respond almost instantly, ensuring they remain ahead of competitors.

This is particularly valuable in high-volume trading, arbitrage opportunities, and algorithmic strategies that depend heavily on data analysis and quick execution.

How High-Frequency Trading Servers Work?

The core of high-frequency trading lies in algorithmic decision-making. Advanced algorithms analyze vast amounts of data, identify opportunities, and send trade instructions. High Frequency Trading Servers are the backbone of this process, as they:

- Receive Real-Time Data: Market data is transmitted at high speed from multiple exchanges.

- Process Information: Servers use optimized hardware and software to analyze this information almost instantly.

- Execute Trades: Once an opportunity is identified, the server sends instructions to execute the trade at the fastest possible speed.

- Minimize Latency: By reducing delays in communication and computation, these servers ensure that no time is wasted in the trade cycle.

Low Latency: The Key to Trading Success

Latency refers to the delay between receiving market data and executing a trade. In traditional systems, latency can range from milliseconds to seconds—far too slow for today’s financial markets.

This is why low-latency trading server services have become indispensable. These services focus on reducing every possible delay, including:

- Network Latency: Optimizing communication between trading systems and stock exchanges.

- Processing Latency: Ensuring servers can process large datasets at lightning speed.

- Execution Latency: Reducing the time it takes to place an order after an opportunity is identified.

With the right low-latency solutions, traders can shave microseconds off their execution times, which can result in millions of dollars in gains over time.

Benefits of High-Frequency Trading Servers:

- Ultra-Fast Execution: Execute trades in microseconds, staying ahead of competitors.

- Scalability: Handle thousands of trades per second without performance degradation.

- Enhanced Profitability: Take advantage of fleeting opportunities with precision.

- Advanced Risk Management: Real-time monitoring and execution reduce exposure to risks.

- Global Reach: Connect seamlessly with multiple exchanges across different regions.

These benefits make High Frequency Trading Servers the backbone of modern financial strategies.

Challenges and Considerations

While these servers offer immense benefits, they also come with challenges:

- High Cost: Deploying and maintaining specialized servers requires significant investment.

- Constant Upgrades: Technology evolves rapidly, meaning systems must be updated frequently.

- Complex Setup: Integrating servers with existing systems and ensuring compliance with financial regulations can be complex.

- Market Volatility: Even with advanced systems, traders are exposed to risks posed by unpredictable market behavior.

Organizations must weigh these factors carefully and work with experienced providers to maximize the benefits of high-frequency trading.

The Future of High-Frequency Trading Servers

The demand for low-latency trading server services is set to grow as financial markets become increasingly data-driven. With advancements in artificial intelligence, quantum computing, and machine learning, trading strategies will become more sophisticated, requiring even faster and more powerful infrastructure.

Future trading servers may incorporate:

- AI-Powered Optimization: Real-time learning to refine trading strategies.

- Quantum Algorithms: Faster analysis of complex datasets.

- Edge Computing: Bringing servers closer to data sources for minimal latency.

These innovations will continue to shape the landscape of financial markets, ensuring speed remains the ultimate advantage.

Conclusion

In the highly competitive world of trading, speed, efficiency, and precision define success. High-frequency trading Servers provide the foundation for modern trading strategies by enabling ultra-fast execution and real-time decision-making. Supported by low-latency trading server services, they help traders stay ahead of market fluctuations and secure profitable opportunities.

For businesses and financial institutions seeking cutting-edge infrastructure, partnering with trusted experts is crucial. SP Sysnet stands out as a reliable provider, offering advanced trading technology solutions tailored to meet the demands of high-frequency and low-latency environments. With SP Sysnet’s expertise, traders can confidently navigate the complexities of global markets and gain the speed advantage they need to succeed.