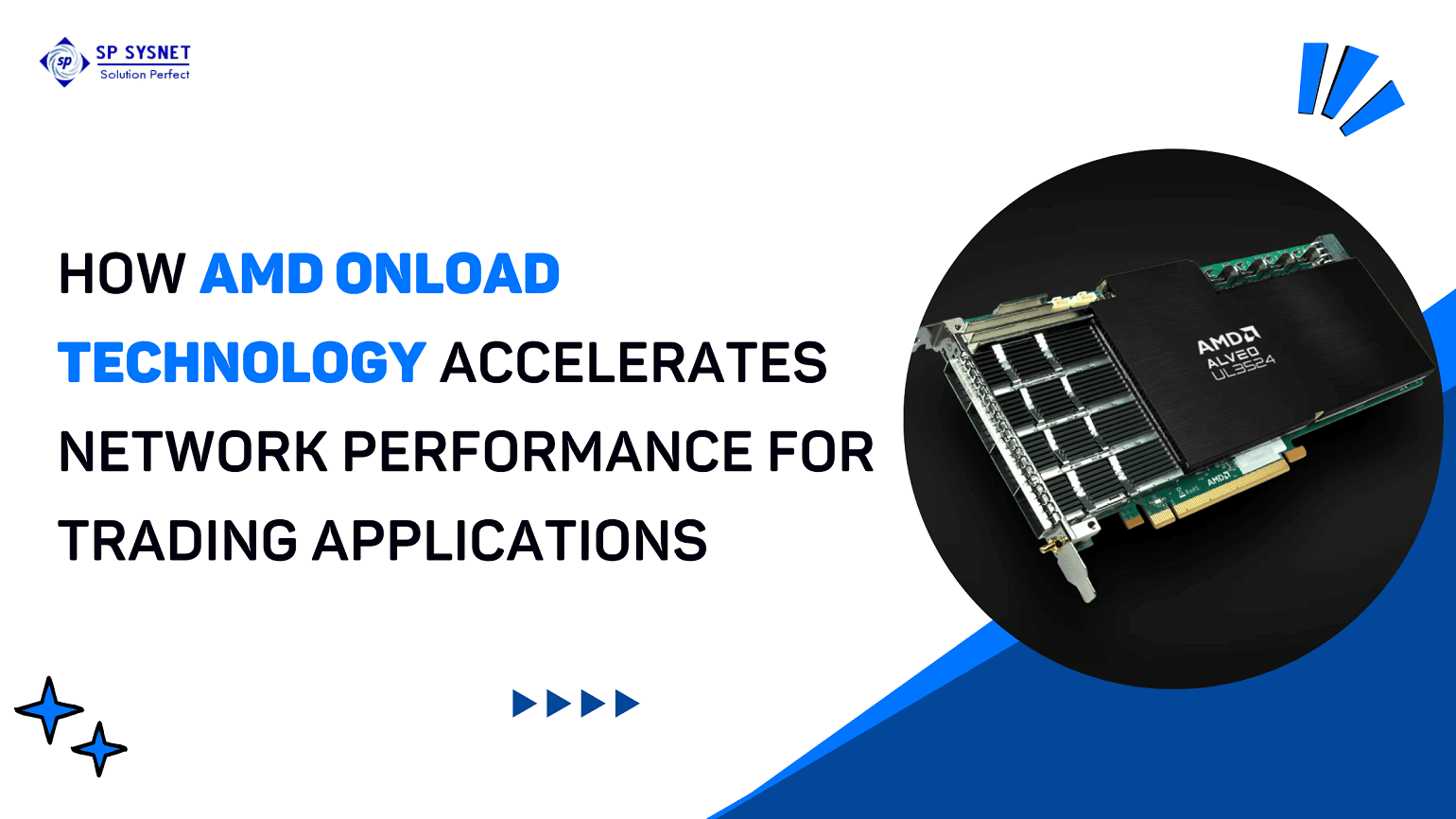

In the fast-paced world of financial trading, speed isn’t just an advantage—it’s a necessity. The difference between profit and loss often depends on microseconds, especially in environments where algorithmic and high-frequency trading dominate. To keep up with these demands, trading firms are turning to Onload technology by AMD — an advanced network acceleration solution that optimizes performance, reduces latency, and enhances efficiency for critical financial systems.

Understanding the Need for Low-Latency Networks in Capital Markets

Financial markets have evolved dramatically over the last decade. Trading floors have gone digital, and with the rise of automated systems, every millisecond counts. Capital market trading networks handle vast amounts of data every second, processing trades, quotes, and market updates in real-time.

However, traditional network stacks — those that rely heavily on operating system (OS) kernel processing — can introduce delays. The OS kernel typically manages all network data traffic, which adds layers of overhead and increases latency. In high-speed trading environments, these inefficiencies can translate into slower decision-making and lost opportunities.

This is where Onload technology by AMD comes in. It addresses the latency bottleneck by optimizing how applications interact with the network interface card (NIC), significantly boosting performance for capital market systems.

What Is Onload Technology by AMD??

Onload technology by AMD is a user-space networking acceleration framework designed to deliver ultra-low latency and high throughput for demanding applications. It effectively bypasses the traditional kernel networking stack, allowing trading applications to communicate directly with the NIC through a highly optimized software layer.

This approach provides two primary advantages:

- Reduced Latency: By cutting out the kernel’s processing time, Onload minimizes the delay between sending and receiving data packets.

- Increased Throughput: Applications can handle more data simultaneously, ensuring smoother performance even during market peaks.

The result is a system capable of supporting the intense speed and reliability requirements of capital market trading networks — where every microsecond impacts profitability.

How Onload Enhances Trading Application Performance?

Trading platforms rely on split-second execution of buy and sell orders. Even a few microseconds of delay can alter trade outcomes or affect profit margins. Onload technology by AMD ensures these systems maintain their edge through a combination of technical advancements:

1. Kernel Bypass for Faster Communication

In a conventional setup, every packet travels through the operating system kernel before reaching the application. This introduces delays due to context switching and memory copying.

Onload eliminates this step by allowing the application to communicate directly with the NIC, significantly reducing latency.

2. Zero-Copy Data Transfers

Data movement between user space and kernel space often leads to performance bottlenecks. Onload employs a “zero-copy” mechanism, which enables direct data transfer without duplication. This ensures faster and more efficient packet processing — a game-changer for trading platforms processing millions of messages per second.

3. CPU Efficiency

Unlike some acceleration technologies that rely on specialized hardware or additional CPUs, Onload is software-based and lightweight. It optimizes CPU utilization by reducing context switching and system calls, freeing up valuable processing resources for trading algorithms.

4. Superior Scalability

Capital markets experience unpredictable trading volumes. Onload’s scalability allows trading firms to maintain consistent network performance, even during surges in activity. This reliability ensures that systems stay responsive under any market condition.

Real-World Benefits for Capital Market Trading Networks

The deployment of Onload technology by AMD provides measurable improvements across key performance metrics in financial trading environments.

1. Ultra-Low Latency Execution

Trading applications can achieve deterministic performance with consistent low-latency communication. This translates to faster order routing, improved execution speed, and higher fill rates.

2. Enhanced Market Data Processing

Market data feeds are the lifeblood of any trading strategy. Onload enables faster ingestion and analysis of market updates, helping traders react in real time to price changes.

3. Reduced Infrastructure Costs

Because Onload improves efficiency at the software level, firms can achieve high performance without investing in expensive proprietary hardware. This makes it a cost-effective solution for trading networks.

4. Better Application Performance Stability

Onload delivers predictable network behavior, which is essential for algorithmic trading models that rely on precise timing. Consistency in latency ensures accurate order execution and strategy performance.

5. Compliance and Reliability

The technology’s robust design ensures compliance with strict industry standards for security and reliability — critical for institutions operating in global capital markets.

Integration with Capital Market Ecosystems

The adaptability of Onload technology by AMD makes it suitable for a range of financial systems, from front-office trading platforms to back-end data analytics engines. It integrates seamlessly with popular middleware, FIX engines, and messaging systems used across global exchanges.

Furthermore, Onload is designed to complement modern infrastructure environments, including virtualized and cloud-native architectures. This means that trading firms transitioning toward hybrid cloud or edge computing setups can still leverage low-latency advantages without sacrificing flexibility.

The Future of Trading Networks with AMD Onload

As digital transformation continues to reshape capital markets, trading organizations need networking solutions that combine speed, efficiency, and scalability. Onload represents a future-proof investment — one that aligns with the growing demand for software-defined acceleration in trading environments.

Its ability to support ultra-low latency, optimize compute resources, and handle real-time market data positions it as a cornerstone technology for next-generation trading systems.

In an industry where milliseconds can redefine market leadership, Onload technology by AMD empowers financial firms to trade smarter, faster, and more efficiently.

Conclusion

In summary, Onload technology by AMD revolutionizes how capital market trading networks operate by delivering the ultra-low latency and high throughput necessary for modern trading applications. Its kernel-bypass architecture, zero-copy transfers, and CPU-efficient design provide traders with a competitive edge in speed-sensitive markets.

For enterprises seeking to deploy or optimize such high-performance trading infrastructures, partnering with experts like SP Sysnet can ensure seamless implementation and integration. SP Sysnet’s advanced IT infrastructure solutions and deep understanding of network acceleration technologies make them a trusted choice for organizations striving for superior trading performance.