High-speed financial trading is a zero-sum game — only the fastest win. In the world of electronic trading, every millisecond can impact your bottom line. That’s where low-latency trading server services step in to offer a crucial competitive edge. By reducing the time it takes to send and receive market data or execute trades, these servers are transforming trading performance for institutional investors, hedge funds, and brokerage firms alike.

Let’s explore how these services can redefine your trading outcomes and why partnering with ultra-low-latency trading service providers is an essential strategic move.

Understanding Low Latency in Financial Trading

Latency, in financial terms, is the delay between an action and its response. In financial trading, it refers to the time taken between a trading signal being generated and the execution of that trade on the exchange.

Low latency, therefore, is the minimization of that time. When every millisecond counts, even a slight delay can result in slippage, missed opportunities, or unfavorable pricing. Low-latency trading server services aim to eliminate these risks by offering the infrastructure, optimization, and network proximity needed to execute orders faster than competitors.

The Critical Role of Server Proximity

One of the key enablers of low latency is physical proximity to exchange data centers. Top ultra-low latency trading service providers ensure their infrastructure is collocated directly within or next to major stock exchange facilities. This minimizes the geographical distance between the servers and the exchange matching engine, reducing round-trip time significantly.

For example, trading firms connected to the New York Stock Exchange via colocated servers can experience a latency as low as 10 microseconds, a decisive advantage when executing high-frequency trading strategies.

Hardware and Network Optimization

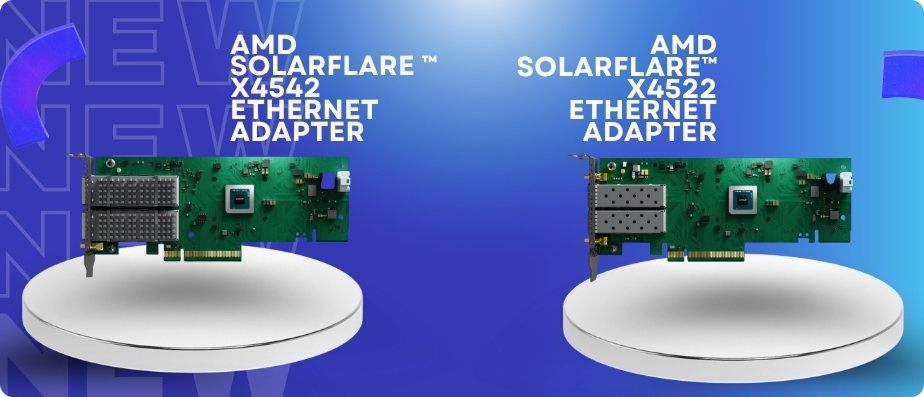

Low latency isn’t just about location; it’s also about the performance of the hardware and networking stack. Low-latency trading server services typically provide:

- High-performance servers with overclocked CPUs, NVMe storage, and large RAM capacities to process multiple instructions at ultra-fast speeds.

- Low-latency network switches and dedicated fiber connections ensure minimal packet loss and faster data transmission.

- FPGA (Field Programmable Gate Array) integration, allowing hardware-level trade execution without going through the software stack, further reduces delays.

Ultra-optimized infrastructures like these help trading firms gain precious microseconds over their competitors.

Algorithmic Trading and Automation

Modern electronic trading relies heavily on algorithms that can scan vast datasets and execute trades autonomously based on predefined rules. However, even the most sophisticated algorithm loses its edge if it’s not supported by a high-speed infrastructure.

Ultra-low-latency trading service providers support algorithmic trading by enabling ultra-fast data ingestion, processing, and order routing. Whether you’re arbitraging price differences across markets or reacting to news-based sentiment in real time, your trading logic performs better on low-latency infrastructure.

Risk Mitigation and Consistency

Contrary to common belief, low latency is not just about being fast — it’s also about being consistently fast. Jitter (inconsistent latency) can lead to unpredictable outcomes, harming long-term performance and increasing exposure to market risks.

By using enterprise-grade low-latency trading server services, you get predictable performance, ensuring your trades execute as intended every single time. Moreover, these services come with redundancies, failover systems, and 24/7 monitoring to reduce the risk of outages and delays.

Competitive Advantage Across Asset Classes

Whether you’re dealing with equities, derivatives, cryptocurrencies, or FX markets, the benefits of low latency remain consistent:

- Equities Trading: React to market movements faster than the competition and capture short-term pricing inefficiencies.

- Options and Derivatives: Speed enhances your ability to hedge or roll over positions before pricing changes.

- Cryptocurrency Markets: In the volatile crypto landscape, being first to act can often mean the difference between profit and loss.

Scalability for Growth

Scalable infrastructure is key to long-term trading success. Leading ultra-low latency trading service providers offer flexible server configurations, hybrid cloud options, and direct exchange connectivity that scales as your operations grow. Whether you’re expanding into new markets or deploying more advanced algorithms, the right service provider ensures your tech keeps pace with your trading goals.

Regulatory Compliance and Security

A robust low-latency solution doesn’t just focus on speed — it also ensures compliance with financial regulations such as MiFID II, SEC Rule 15c3-5, and others, depending on your geography. Features like trade logs, secure access controls, and audit trails are standard with premium services.

Top-tier low-latency trading server services also come equipped with advanced security features, including DDoS protection, intrusion detection, and firewalls, ensuring the safety of your trading environment.

Choosing the Right Partner for Low Latency Trading

Selecting a trusted and experienced service provider can make a measurable difference in your trading success. Look for a partner that offers:

- Proven expertise in financial markets

- Customizable server and network configurations

- Real-time monitoring and support

- Direct colocation with major exchanges

- Cost-effective scalability

Conclusion

As competition intensifies and markets evolve faster than ever, trading firms must rethink their infrastructure. Speed is no longer a luxury — it’s a necessity. Whether you’re an institutional trader or a growing hedge fund, investing in low-latency trading server services offers a tangible edge in the race for market superiority.

Partnering with expert ultra-low-latency trading service providers ensures that your trading operations are backed by the best-in-class technology, infrastructure, and support needed to thrive in high-frequency environments.

For powerful, enterprise-grade low-latency trading infrastructure designed to keep you ahead of the market, trust SP Sysnet, your partner in intelligent trading technology.