In today’s financial markets, where milliseconds can mean the difference between profit and loss, the demand for low-latency trading infrastructure has never been higher. As algorithmic and high-frequency trading (HFT) dominate global exchanges, traders are constantly seeking ways to reduce delays, increase execution speed, and gain an upper hand in the race to capture fleeting opportunities. A robust and optimized low-latency infrastructure isn’t just a luxury anymore—it’s an essential foundation for success in modern trading.

What Is Low Latency Trading Infrastructure?

Low-latency trading infrastructure refers to the specialized technology framework that minimizes the time it takes for a trading order to travel from the trader’s system to the exchange and back. This includes hardware, software, network components, and co-location services designed to deliver microsecond-level speeds.

In simpler terms, it’s the backbone of high-speed trading—enabling traders to send, receive, and execute orders faster than competitors. Every component, from the server’s processing power to the physical distance between data centers and stock exchanges, contributes to latency. Reducing these delays can directly influence profitability.

Why Speed Matters in Modern Trading?

Financial markets today operate at lightning speed. Algorithms continuously monitor prices, execute orders, and respond to fluctuations in fractions of a second. In such an environment, even a delay of a few milliseconds can result in missed trades or unfavorable prices.

For example, if a trading algorithm spots a price discrepancy across exchanges, it must act instantly. Any lag caused by inefficient infrastructure can erase potential profits or lead to losses. This is why low latency trading infrastructure has become a strategic investment for trading firms, hedge funds, and banks looking to maximize returns and reduce risk.

Moreover, regulators and exchanges are also adapting to this high-speed environment, ensuring fair access to market data and order execution. Yet, having a faster infrastructure still provides an undeniable competitive edge—helping traders make split-second decisions more effectively than others.

Core Components of Low Latency Infrastructure

Building a powerful low latency trading system involves optimizing every layer of the trading stack. Here are some key components:

- Co-location Services – Traders host their servers as close as possible to the exchange data centers. Physical proximity reduces the time it takes for data to travel, cutting latency significantly.

- Optimized Network Connectivity – Dedicated fiber-optic lines, microwave links, and high-speed routers ensure rapid data transmission between trading venues and systems.

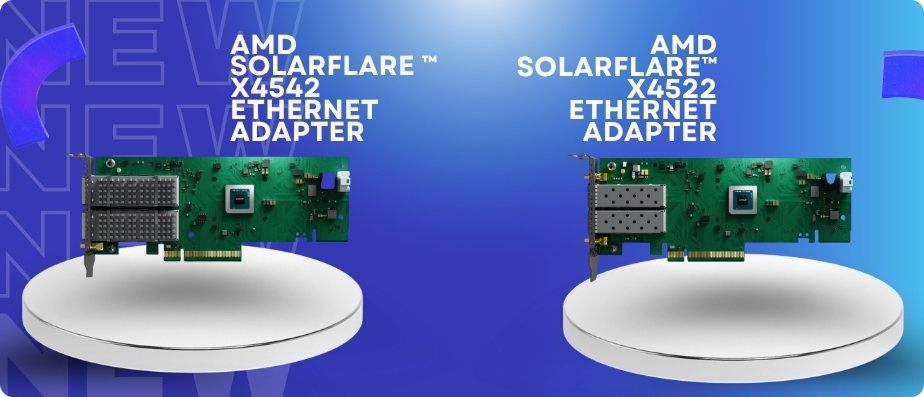

- High-Performance Hardware – Specialized servers, network interface cards (NICs), and custom FPGA (Field-Programmable Gate Array) chips are often used to process orders faster than traditional systems.

- Efficient Software Architecture – Lightweight trading applications with minimal code paths and fast execution logic are crucial for reducing software-induced latency.

- Real-Time Market Data Feeds – Access to ultra-low latency data streams ensures traders receive the latest market updates instantaneously, allowing immediate response to price movements.

- System Monitoring and Optimization – Constant monitoring helps detect and address any performance bottlenecks before they affect trading outcomes.

Benefits of Low Latency Trading Infrastructure

Implementing a low latency framework can transform trading performance in several ways:

- Faster Execution Speeds: Orders are executed almost instantly, helping traders secure optimal prices.

- Improved Profit Margins: By entering and exiting trades faster, traders can capture micro-opportunities that others miss.

- Reduced Slippage: Lower latency means fewer price deviations between the order placement and execution.

- Enhanced Market Competitiveness: Firms with superior infrastructure gain a strategic edge over slower competitors.

- Better Risk Management: Real-time monitoring and faster reactions help traders minimize exposure to sudden market volatility.

Choosing the Right HFT Infrastructure Provider

Setting up and managing such advanced systems requires specialized expertise. This is where an experienced HFT infrastructure provider becomes essential. They help design, implement, and maintain the network, hardware, and software components that support high-frequency trading operations.

A trusted provider ensures:

- Minimal network latency through optimized architecture

- Secure and compliant trading environments

- Continuous system monitoring and performance tuning

- Scalable infrastructure to handle high trade volumes

Selecting the right partner allows traders to focus on developing strategies while the provider handles the complex technical framework behind the scenes.

The Future of Low Latency Trading

As technology evolves, so do trading systems. Emerging trends such as quantum computing, 5G networks, and AI-driven analytics are pushing latency limits even further. Future-ready firms are already upgrading their systems to ensure they remain at the forefront of market innovation.

With exchanges introducing faster matching engines and global connectivity becoming more seamless, the emphasis on ultra-low latency will only intensify. Traders and institutions that invest early in efficient infrastructure will continue to outperform those who rely on outdated systems.

Conclusion

In the world of algorithmic and high-frequency trading, speed defines success. Low latency trading infrastructure is not just a technological upgrade—it’s a strategic necessity that can determine profitability and market position. Partnering with the right HFT infrastructure provider ensures your systems operate with peak efficiency, minimal lag, and maximum precision.

If you’re looking to build a next-generation trading setup that delivers unmatched performance, SP Sysnet offers comprehensive solutions tailored to the evolving needs of high-speed trading firms. Their expertise in networking and low latency systems provides the reliability and edge today’s traders simply can’t afford to ignore.