In today’s fast-moving financial markets, speed is everything. A delay of even a few microseconds can mean the difference between making a profit or missing an opportunity. This is why trading firms, hedge funds, and financial institutions are investing heavily in low-latency trading infrastructure. Simply put, it is the backbone that allows traders to execute orders at lightning-fast speeds with extreme precision and reliability.

What Is Low Latency Trading Infrastructure?

Low latency trading infrastructure refers to the complete technology setup that minimizes delays between a trading decision and its execution in the market. This includes high-speed servers, optimized networks, advanced hardware, and specialized software working together to reduce processing and transmission time.

In traditional systems, data passes through multiple layers, causing small delays at each step. In high-frequency and algorithmic trading, these delays add up quickly. A low latency trading infrastructure removes unnecessary bottlenecks so that market data is received, analyzed, and acted upon almost instantly.

Why Speed Matters in Modern Trading?

Financial markets today are highly competitive and automated. Prices change in milliseconds, and thousands of trades can happen in the blink of an eye. Traders using slower systems often find that by the time their order reaches the exchange, the price has already moved.

With a well-designed low-latency trading infrastructure, firms can:

- React to market changes faster

- Execute trades at more accurate prices

- Reduce slippage and execution risk

- Gain a competitive edge over slower participants

This speed advantage is especially important for high-frequency trading (HFT), arbitrage strategies, and market-making activities.

Key Components of a Low Latency Trading Infrastructure

To achieve ultra-fast execution, every part of the trading setup must be optimized. Let’s look at the main building blocks.

1. High-Performance Servers

Powerful servers with fast processors and memory are essential. These systems are designed to handle large volumes of market data without delays. They are often placed close to exchanges through colocation services to reduce physical distance and network travel time.

2. Optimized Network Design

Network speed is just as important as computing power. Low-latency networks use direct routing, minimal hops, and high-speed connections to ensure data travels the shortest and fastest path possible.

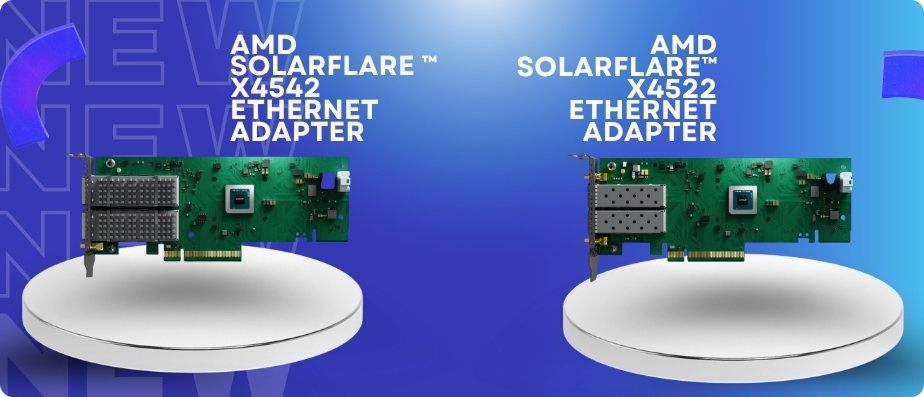

3. Low Latency ASIC Network Card

One of the most critical hardware components is the Low latency ASIC network card. Unlike standard network cards, these are built specifically for speed-sensitive environments. They offload processing tasks from the CPU, handle data packets more efficiently, and reduce jitter and delays. This allows trading applications to receive and send data much faster.

4. Efficient Trading Software

Software must be lightweight and optimized. Unnecessary processes, logs, or background tasks can slow down execution. Many firms use custom-built trading platforms that are fine-tuned for speed and stability.

How Low Latency Improves Market Execution?

Fast execution is not just about speed—it is also about accuracy and consistency. A strong low-latency trading infrastructure ensures that orders reach the market exactly when intended.

This leads to:

- Better order fill rates

- Reduced price slippage

- Lower chances of rejected or delayed orders

- More predictable trading performance

Over time, these benefits can significantly improve profitability and reduce operational risk.

Challenges in Building Low Latency Systems

While the benefits are clear, creating and maintaining a low latency trading infrastructure is not simple. It requires careful planning, deep technical knowledge, and constant monitoring.

Some common challenges include:

- High costs of specialized hardware and colocation

- Complexity in network tuning and optimization

- Need for ongoing upgrades as technology evolves

- Managing reliability while pushing systems to their speed limits

This is why many firms prefer working with experienced technology partners who understand the demands of high-speed trading environments.

Future Trends in Low Latency Trading

As markets continue to evolve, the demand for faster and smarter systems will only increase. Innovations in hardware acceleration, smarter network cards, and more efficient data processing are shaping the future of trading technology.

Advanced solutions using Low latency ASIC network card technology and next-generation networking are helping firms stay ahead. At the same time, there is a growing focus on stability, security, and scalability alongside speed.

Final Thoughts

In modern financial markets, speed is no longer a luxury—it is a necessity. A well-designed low latency trading infrastructure allows firms to execute trades faster, reduce risk, and stay competitive in a highly automated environment. By combining high-performance servers, optimized networks, and specialized hardware like a Low latency ASIC network card, trading firms can unlock true lightning-fast market execution.

For organizations looking to build or upgrade their trading technology with reliable, high-performance solutions, partnering with an expert provider like SP Sysnet can make all the difference in achieving speed, stability, and long-term success.

FAQs

- What is low latency trading infrastructure?

Low latency trading infrastructure refers to high-speed systems designed to execute trades with minimal delay. It uses advanced servers, optimized networks, and fast data connections to reduce the time between placing and completing a trade. - Why is low latency important in trading?

In financial markets, even a few milliseconds can impact prices. Low latency helps traders react faster to market changes, secure better prices, and reduce the risk of slippage during high-volatility periods. - Who benefits the most from low latency trading infrastructure?

High-frequency traders, institutional investors, proprietary trading firms, and algorithmic traders benefit the most. Faster execution gives them a competitive edge in fast-moving markets. - How does low latency improve trade execution quality?

Low latency ensures quicker order processing and real-time market access. This results in more accurate order fills, fewer delays, and improved overall trading performance.