In the fast-paced world of financial markets, where every microsecond counts, speed has become the most valuable currency. The financial trading landscape has evolved dramatically over the past decade, and now, milliseconds—or even nanoseconds—can determine the difference between profit and loss. This evolution has given rise to a new class of technological innovators known as Ultra Low Latency Trading Service Providers, who are redefining the limits of performance, efficiency, and precision in financial trading systems.

The Need for Speed in FinTech

Modern FinTech companies rely on algorithms that execute thousands of trades per second. These algorithmic trading systems depend on lightning-fast data transmission and execution speeds to make decisions and capitalize on market opportunities. As trading volumes increase and competition intensifies, latency—the delay between the initiation of a transaction and its completion—has become a critical factor.

Low latency directly impacts how quickly traders receive market data and execute buy or sell orders. Even a delay of a few microseconds can mean missing out on profitable opportunities. This is where Ultra Low Latency Trading Service Providers step in, offering infrastructure and technology solutions that minimize transmission time between trading systems and exchange servers.

What Makes Ultra Low Latency Trading Possible?

The core principle of low-latency trading lies in optimizing every component of the trading ecosystem—hardware, network, and software. To achieve ultra-low latency, service providers implement several sophisticated strategies:

- Optimized Network Infrastructure:

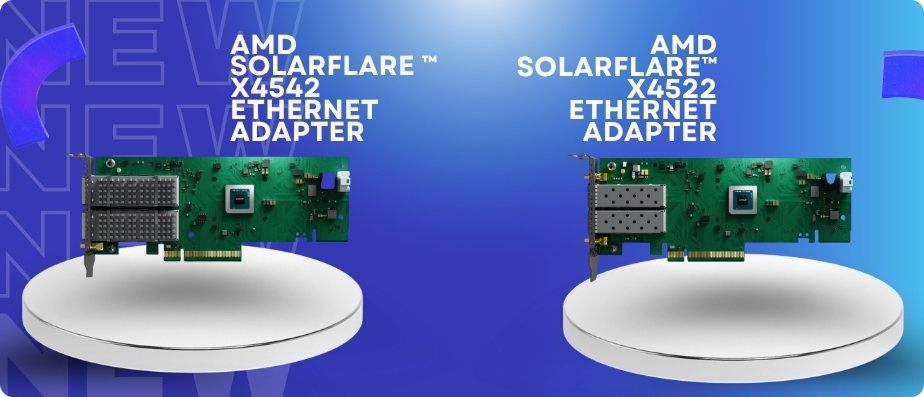

By deploying servers in close proximity to stock exchanges (a practice known as colocation), trading systems can reduce the physical distance that data needs to travel. This significantly cuts down latency. - High-Performance Hardware:

Low latency trading servers services rely on specialized hardware optimized for speed. This includes high-frequency trading (HFT) servers, FPGA (Field Programmable Gate Array) cards, and network adapters designed specifically for rapid data processing and transmission. - Streamlined Data Processing:

Ultra low latency trading systems prioritize data paths to eliminate unnecessary processing steps. This is achieved through kernel bypass technology, hardware acceleration, and custom-tuned operating systems that ensure minimal delay. - Efficient Network Connectivity:

Direct connectivity with financial exchanges through fiber-optic or microwave links ensures the fastest data transfer. Advanced routing protocols further minimize detours, ensuring that data travels the shortest possible path. - Real-Time Monitoring and Optimization:

Continuous monitoring of trading systems allows for immediate identification of bottlenecks. Real-time analytics help optimize performance and maintain ultra-low latency even during peak trading hours.

The Role of Low Latency in Modern Financial Markets

The importance of low latency extends beyond high-frequency trading. It influences multiple aspects of the global financial ecosystem, including retail trading platforms, institutional trading desks, and hedge funds.

- Algorithmic Trading:

Automated trading algorithms depend on near-instantaneous access to data. The faster they can react to market fluctuations, the higher the potential for profit. - Market Liquidity:

With faster execution speeds, liquidity providers can quote more competitive prices, improving market efficiency. - Risk Management:

Ultra low latency systems allow traders to react instantly to market volatility, minimizing risk exposure and ensuring compliance with trading regulations. - Competitive Advantage:

In today’s FinTech-driven world, having access to Low latency trading servers services is not just a technical advantage—it’s a strategic necessity. Traders and institutions leveraging these systems can execute trades faster than competitors, leading to improved profitability and market performance.

Challenges in Achieving Ultra Low Latency

While the potential benefits are immense, building and maintaining an ultra-low latency environment presents its own set of challenges:

- High Infrastructure Costs:

Developing high-speed trading infrastructure requires heavy investment in hardware, network optimization, and data center facilities. - Regulatory Compliance:

As markets become faster, regulators are imposing stricter rules to ensure fair trading practices. Maintaining compliance while optimizing for speed can be a complex balancing act. - Technological Complexity:

Achieving true ultra-low latency requires specialized technical expertise. Continuous upgrades and maintenance are necessary to keep up with evolving exchange protocols and network technologies. - Geographical Constraints:

The physical distance between trading servers and exchanges still plays a crucial role in latency. While global networks are improving, the speed of light remains a fundamental limitation.

The Future of FinTech Speed

As the financial world embraces digital transformation, Ultra Low Latency Trading Service Providers are at the forefront of shaping the next era of trading. Emerging technologies such as quantum computing, 5G, and edge computing are expected to further reduce latency and open new possibilities in the FinTech sector.

- Quantum Networking:

Quantum communication promises near-instant data transfer with unprecedented security, which could revolutionize latency-sensitive trading. - Artificial Intelligence Integration:

AI-driven systems can analyze massive data streams and make split-second trading decisions, pushing the demand for even lower latency infrastructures. - Edge Computing and 5G Networks:

With data processing happening closer to the source, traders can experience minimal delays and higher efficiency. - Hybrid Cloud Deployments:

Combining the scalability of cloud systems with dedicated physical servers ensures flexibility without compromising on latency performance.

Conclusion

The race for speed in financial trading will only accelerate as markets evolve and technology advances. The demand for precision, performance, and near-instantaneous execution continues to drive innovation among Ultra Low Latency Trading Service Providers. With the integration of next-generation hardware and cutting-edge connectivity solutions, Low latency trading servers services are becoming indispensable for modern trading success.

For financial institutions seeking reliability, scalability, and speed, partnering with a trusted technology leader is key. SP Sysnet stands at the forefront of providing high-performance infrastructure and trading solutions, empowering FinTech companies to stay ahead in the ultra-competitive trading landscape.