In the competitive world of finance, milliseconds can mean the difference between profit and loss. High-Frequency Trading (HFT) is one of the most technologically advanced areas of the financial markets, relying on ultra-low-latency systems, optimized algorithms, and powerful computing resources. To succeed, firms need not just the right strategies but also the right hardware. This is where Lenovo servers are making a significant impact, offering unmatched speed, reliability, and scalability to trading firms worldwide.

Understanding High-Frequency Trading

High-Frequency Trading involves executing thousands of trades per second, leveraging powerful algorithms and advanced computing systems to take advantage of tiny market inefficiencies. The success of HFT depends on two major factors:

- Latency: how quickly a system can process and respond to data.

- Reliability: ensuring consistent performance without downtime or failure.

This chooses server infrastructure critical. Traders and financial institutions are increasingly relying on specialized hardware built to handle extreme performance demands.

The Role of Servers in HFT

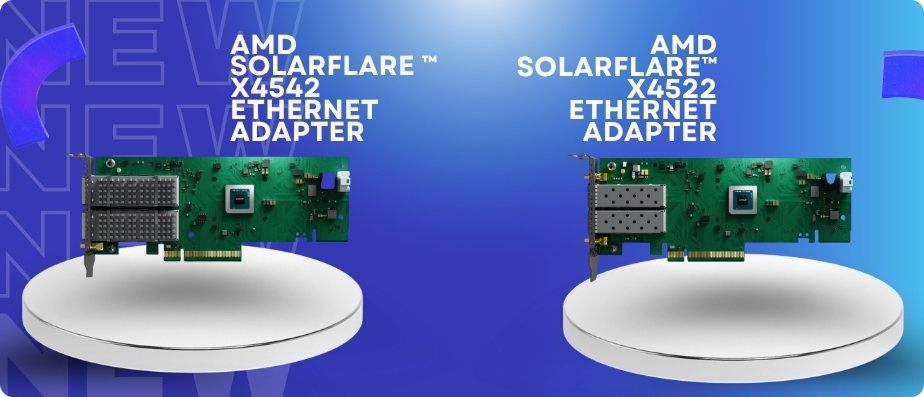

At the heart of HFT systems is the server. Unlike standard enterprise servers, HFT-specific servers must deliver:

- Ultra-low latency processing.

- High throughput for large volumes of data.

- Reliability under extreme loads.

- Scalability for evolving trading strategies

An effective HFT infrastructure provider understands that these systems cannot be generic. They need to be optimized for market conditions, algorithm execution, and rapid data analysis. Lenovo has stepped into this niche with hardware specifically designed for performance-sensitive trading environments.

Why Lenovo Servers Stand Out?

Lenovo has become a trusted name in enterprise IT, and its move into high-frequency trading systems has positioned it as a strong competitor in this domain. Lenovo servers bring several key advantages:

- Ultra-Low Latency Performance: In HFT, speed is everything. Lenovo’s servers use cutting-edge processors, fast memory configurations, and optimized input/output systems to reduce latency to the absolute minimum. The result is faster decision-making and trade execution.

- Reliability and Consistency: Financial institutions cannot afford downtime. Lenovo servers are engineered for round-the-clock performance, ensuring stability even under the most demanding trading workloads. Built with enterprise-grade components, they guarantee high uptime.

- Scalability for Growth: As firms evolve and trading algorithms become more sophisticated, infrastructure must scale accordingly. Lenovo servers allow organizations to expand without sacrificing performance, making them ideal for firms with long-term growth plans.

- Energy Efficiency: Data centers powering HFT operations consume enormous amounts of energy. Lenovo focuses on energy-efficient server designs, helping trading firms lower operational costs while maintaining peak performance.

- Customization Options: Every trading firm has unique needs. Lenovo provides the flexibility to configure servers according to workload requirements—whether optimizing for CPU performance, memory, or networking capabilities.

Benefits for Financial Institutions

The adoption of Lenovo servers provides trading firms with several tangible benefits:

- Competitive Edge: Faster execution leads to better profitability and market positioning.

- Cost Efficiency: Optimized power consumption and high reliability reduce overhead costs.

- Future-Readiness: Scalable systems ensure institutions remain ahead as trading strategies evolve.

- Reduced Risk: Robust hardware minimizes downtime and system failures, which can otherwise lead to significant financial losses.

Lenovo vs. Traditional Infrastructure

Traditional servers designed for enterprise applications may not deliver the ultra-low latency required for high-frequency trading. While they work well for general business applications, they fall short in environments where nanoseconds determine profitability.

In contrast, Lenovo has focused specifically on bridging this gap by delivering hardware tailored for HFT. By partnering with an experienced HFT infrastructure provider, financial firms can deploy Lenovo’s advanced systems effectively and maximize their performance potential.

The Future of HFT with Lenovo

As trading continues to evolve, HFT systems will become even more dependent on advanced computing infrastructure. Artificial intelligence and machine learning will play a bigger role in trading strategies, requiring servers that can process vast amounts of data with minimal delay.

Lenovo’s ongoing investment in research and development positions it well to meet these challenges. By combining performance, flexibility, and efficiency, Lenovo servers are set to remain a powerhouse in high-frequency trading for years to come.

Conclusion

High-frequency trading is one of the most demanding applications of modern computing. The infrastructure behind it must be fast, reliable, and future-proof. With their cutting-edge designs and proven reliability, Lenovo servers are emerging as a clear choice for financial institutions aiming to dominate the markets.

For trading firms, success depends not only on powerful servers but also on partnering with the right HFT infrastructure provider. Choosing an expert partner ensures seamless integration, proper optimization, and ongoing support. In this space, SP Sysnet stands out as a trusted name, delivering tailored solutions that help firms unlock the full potential of Lenovo technology.