In the fast-moving world of financial markets, every millisecond counts. Traders and institutions rely on speed, accuracy, and efficiency to gain a competitive edge. This is why high frequency trading solutions have become the backbone of modern trading strategies. To unlock the full potential of these systems, businesses increasingly depend on specialized HFT infrastructure providers that deliver cutting-edge technology designed for ultra-low latency and consistent performance.

The Role of High Frequency Trading in Modern Markets

High frequency trading (HFT) has transformed how global financial markets operate. By using advanced algorithms and lightning-fast execution, firms can process thousands of trades in fractions of a second. This allows traders to capitalize on micro-opportunities that would be impossible with traditional methods.

However, achieving success in HFT isn’t just about algorithms—it requires robust infrastructure capable of supporting next-level performance.

Why Infrastructure Matters for HFT?

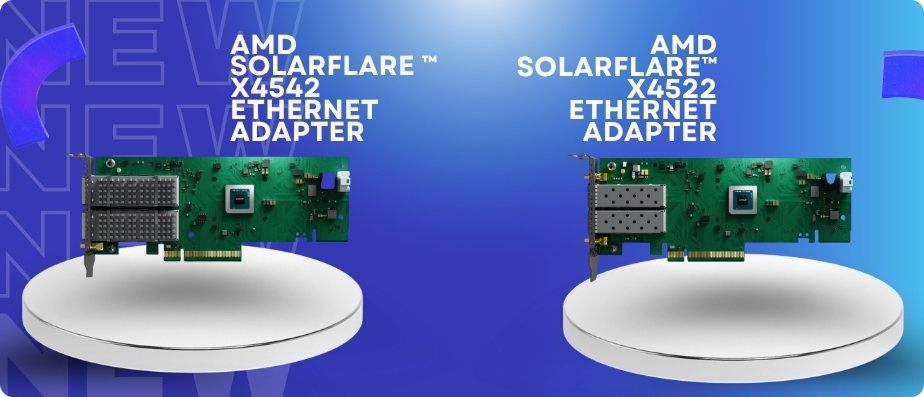

A reliable HFT setup is more than just powerful servers. It includes:

- Low-latency networks to minimize delays between market signals and order execution.

- High-performance servers optimized for real-time processing.

- Scalable architecture to support rapid growth and evolving strategies.

- Advanced monitoring tools to ensure system reliability under high-stress conditions.

This is where an expert HFT infrastructure provider plays a vital role—designing and managing solutions that enable firms to stay ahead in competitive trading environments.

The Shift to Next-Gen HFT Systems

As markets evolve, so does the need for next-gen HFT systems. These solutions are built to handle:

- Increasingly complex trading algorithms.

- Expanding global market data streams.

- Enhanced security to protect sensitive trading information.

- Greater energy efficiency for sustainable operations.

Next-gen systems integrate AI, machine learning, and predictive analytics to further optimize strategies, making them a crucial investment for forward-looking trading firms.

Key Benefits of High Frequency Trading Solutions

Enterprises investing in advanced HFT setups can expect:

- Ultra-fast execution that creates a measurable market advantage.

- Reduced latency, ensuring trades are placed ahead of competitors.

- Operational resilience with failover systems and redundancy.

- Adaptability to changing market regulations and conditions.

These advantages help traders maximize profitability while minimizing risks in highly volatile markets.

Choosing the Right HFT Infrastructure Provider:

Selecting the right partner is critical. A proven HFT infrastructure Solutions offers more than just hardware—they deliver end-to-end solutions, from architecture design and deployment to monitoring and ongoing optimization. The right provider ensures that infrastructure aligns with business goals, compliance requirements, and long-term scalability.

Conclusion

In financial markets where speed and accuracy define success, investing in advanced infrastructure is no longer optional—it’s essential. By adopting high frequency trading solutions powered by next-gen HFT systems and guided by SP Sysnet, an experienced HFT infrastructure provider, firms can unlock new levels of performance, efficiency, and resilience. For traders aiming to stay ahead, the future of HFT lies in optimized infrastructure built for tomorrow’s challenges.